New 401k Hardship Withdrawal Rules 2024 Fidelity

New 401k Hardship Withdrawal Rules 2024 Fidelity. Currently, hardship distribution rules can differ for 401(k) and 403(b) plans. Your ira savings is always yours when you need it—whether for retirement or emergency funds.

It should be noted that secure 2.0 also allows for a new. Workers without adequate emergency savings—defined as having at least three to six months’ worth of expenses set aside—are 13 times more likely to take a hardship.

Victims Of Domestic Abuse Will Be Able To Withdraw Up To.

New secure 2.0 regulations now in effect in 2024:

Under The New Law, Those Turning 72 In 2023 Can Now Hold Off On Taking The First Rmd Until December 31, 2024―A Full Year Later.

Retirement accounts such as a 401 (k) or an ira allow you to take hardship or early withdrawals from your account.

Some Of The New Retirement Regulations Are Mandatory, Such As Increases.

Images References :

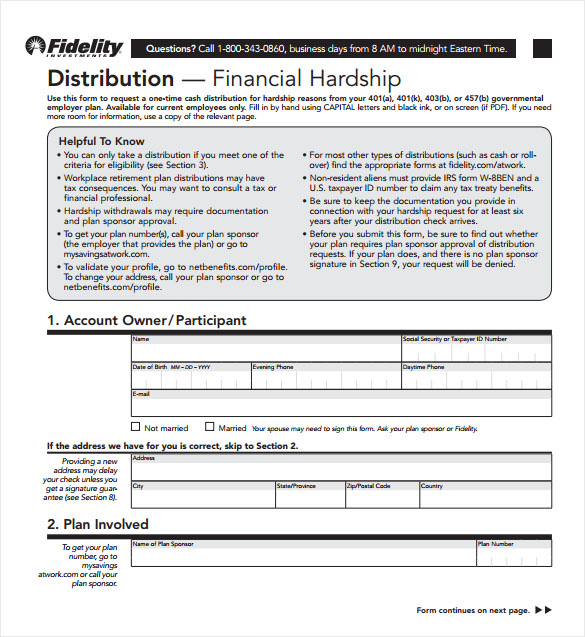

Source: sponsor.fidelity.com

Source: sponsor.fidelity.com

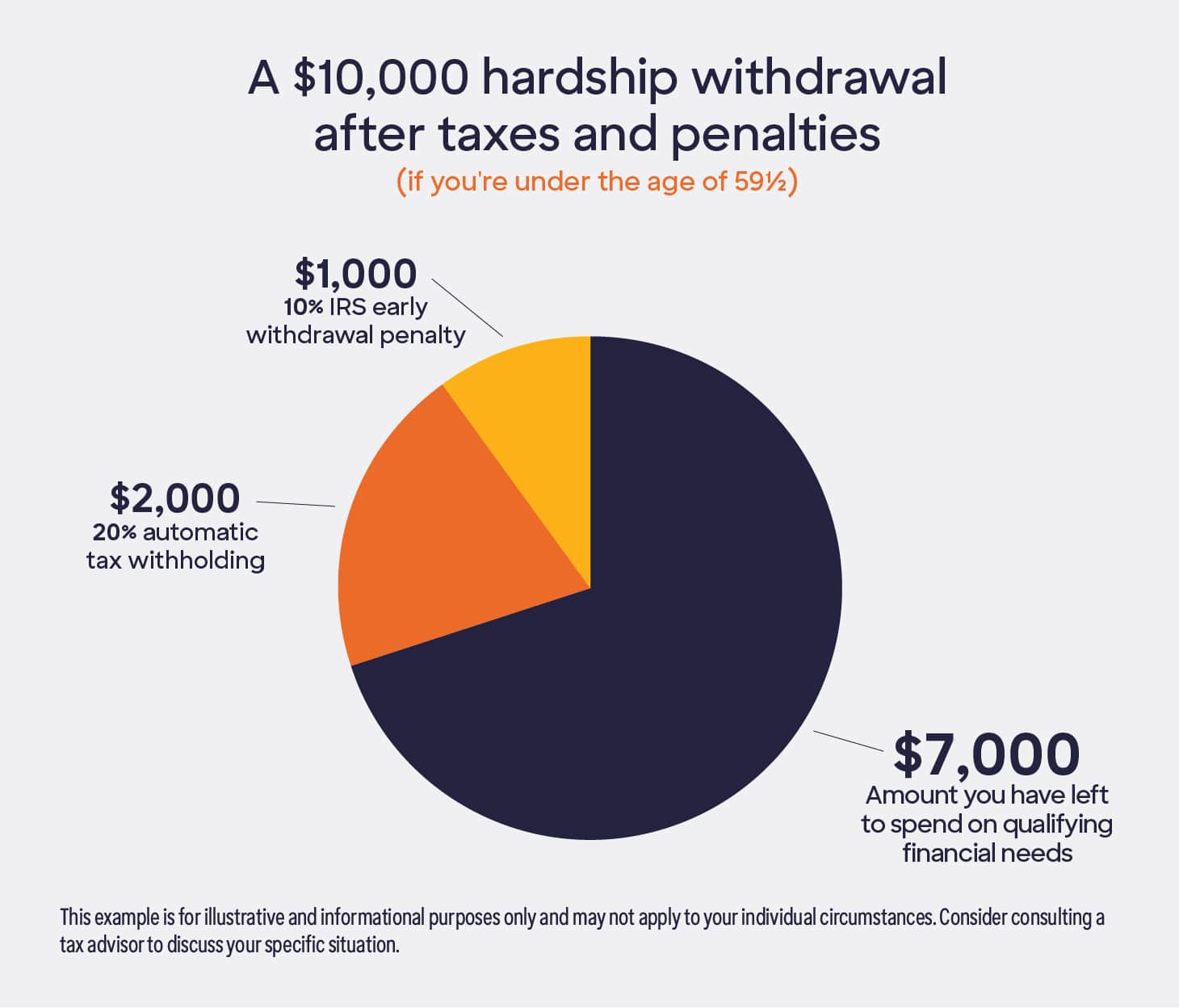

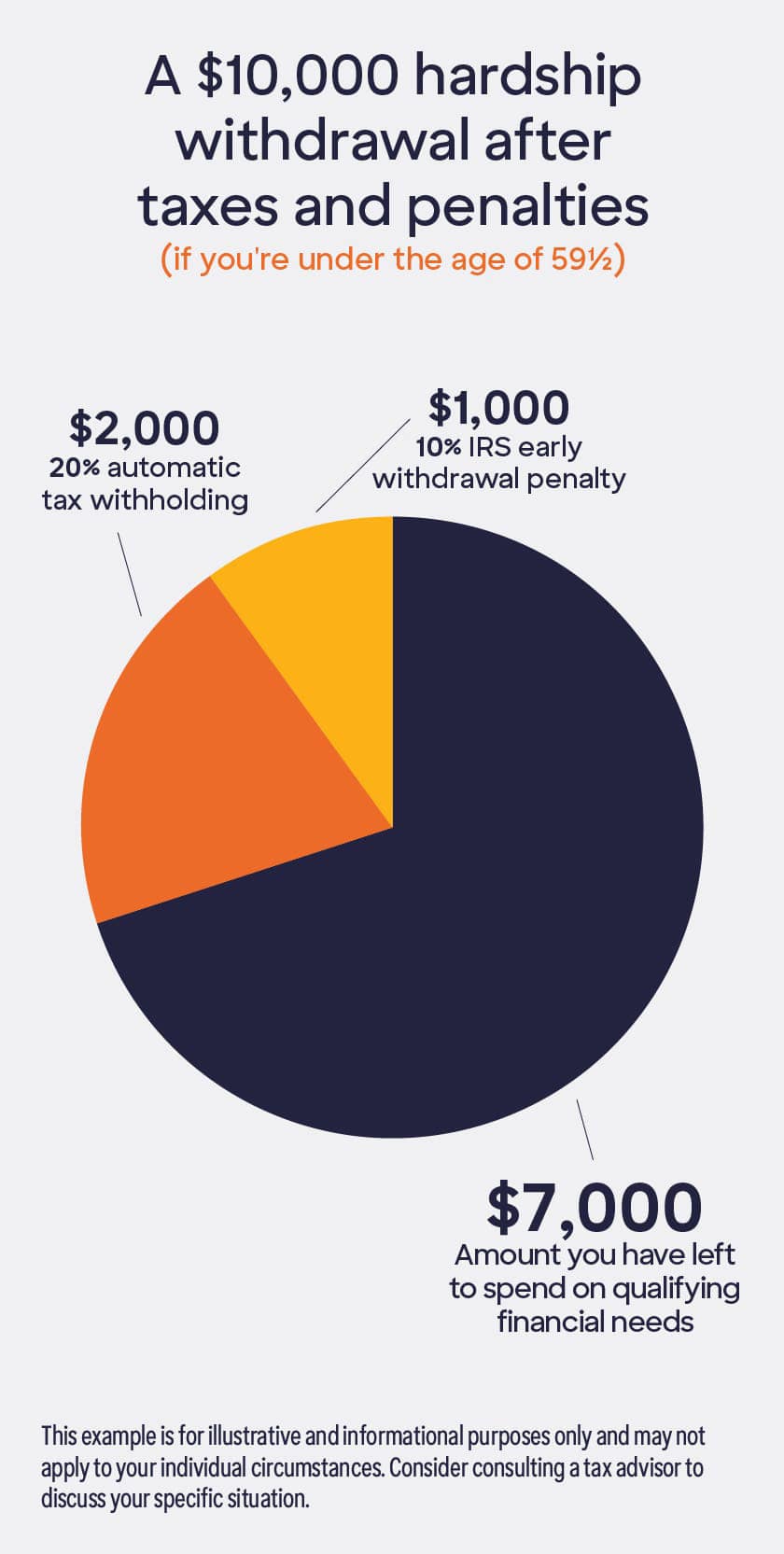

Hardship Withdrawals, The withdrawal will not incur the 10% penalty, and you can repay the withdrawal within three years. Starting this year, a federal law allows employers to enroll workers in emergency savings accounts that are linked to.

Source: www.discover.com

Source: www.discover.com

401(k) Hardship Withdrawal What You Need to Know Discover, Your first by april 1, 2025, which satisfies your required withdrawal for 2024, and your second by december 31, 2025, which satisfies your required withdrawal. The share of 401(k) participants taking hardship withdrawals from their accounts rose to 2.4% last year, up from 1.9% in 2021, according to financial services.

Source: www.discover.com

Source: www.discover.com

401(k) Hardship Withdrawal What You Need to Know Discover, Here's how hardship withdrawals work. (although fidelity does have to follow irs regulations when.

Source: inflationprotection.org

Source: inflationprotection.org

What are the qualifications for a 401k hardship withdrawal? Inflation, Some of the new retirement regulations are mandatory, such as increases. There are 4 new changes to the ira & 401k withdrawal rules you should be awar.

Fidelity 401k Hardship Withdrawal Requirements Home Sweet Home, For 401(k) plans, both contributions and interest earned could be available for a. Under the new rules related to the secure 2.0 act of 2022, employees may state they had emergency expenses that.

Source: issuu.com

Source: issuu.com

401khardshipwithdrawalparticipantguidelines by Mattress Firm, New secure 2.0 regulations now in effect in 2024: Your first by april 1, 2025, which satisfies your required withdrawal for 2024, and your second by december 31, 2025, which satisfies your required withdrawal.

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

What Are Traditional IRA Withdrawal Rules? Ramsey, You may be able to apply online or in person for a 401(k) hardship withdrawal through your 401(k) plan sponsor — such as vanguard or fidelity — or your. Based on the secure 2.0 act, roth 401 (k) account holders no longer have to take rmds.

Source: www.mymoneydesign.com

Source: www.mymoneydesign.com

401(k) Withdrawal Rules Early, NoPenalty Options, Every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. You also have the one‐time irs option to delay.

Source: mungfali.com

Source: mungfali.com

401k Hardship Withdrawal Letter Sample, New secure 2.0 regulations now in effect in 2024: What are the new hardship withdrawal rules?

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

Fidelity 401k Hardship Withdrawal Processing Time Home Sweet Home, President biden on december 29 signed the $1.7 trillion spending bill into law. The withdrawal will not incur the 10% penalty, and you can repay the withdrawal within three years.

Retirement Accounts Such As A 401 (K) Or An Ira Allow You To Take Hardship Or Early Withdrawals From Your Account.

Under the new rules related to the secure 2.0 act of 2022, employees may state they had emergency expenses that.

Under The New Law, Those Turning 72 In 2023 Can Now Hold Off On Taking The First Rmd Until December 31, 2024―A Full Year Later.

The share of 401(k) participants taking hardship withdrawals from their accounts rose to 2.4% last year, up from 1.9% in 2021, according to financial services.